A deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying. In most cases your copay will not go toward your deductible. What is a copay? A copay is a fixed amount of money established by an insurance plan as a cost sharing measure for certain health services. Depending on your health plan, you may have a deductible and copays. A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. Learn the differences between high and low deductible health insurance plans and what the benefits are so that you can make a more informed decision. Among people who buy their own health insurance in the individual market, deductibles are even higher. EHealthinsurance, an online brokerage, reported that for 2020 coverage selected by consumers who used eHealthinsurance and didn't qualify for any ACA subsidies, the average individual deductible was $4,364. A health insurance deductible is a specified amount or capped limit you must pay first before your insurance will begin paying your medical costs. For example, if you have a $1000 deductible, you.

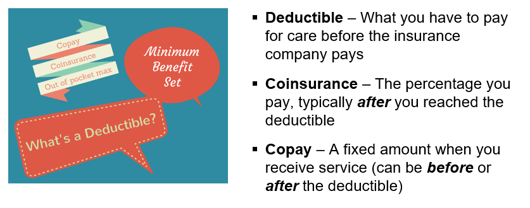

One of the questions we routinely get is about the differences between deductibles vs copays on health insurance plans. Both benefits will appear as a flat rate amount on your health plan’s summary of benefits, but they have vastly different meanings. Furthermore, the out of pocket costs are significantly different when comparing deductibles vs copays. This article discusses the basic definition differences between deductibles vs copays.

Deductibles

Insurance companies will impose deductible requirements on health insurance plans in certain situations. These deductibles are an accumulation of claims that you need to pay out of pocket first, before the insurance company starts covering the claim. Usually, insurance companies will split a percentage of the claim (ie. coinsurance) with you after the deductible is satisfied. Sometimes, you will receive a copay benefit after your deductible is satisfied. We recommend checking your summary of benefits to verify your coverage.

Deductibles are a way for insurance companies to shift the cost of the claim onto you first. After the deductible, they will start paying part of the claim. Because of this, it is usually a good idea to avoid plans with deductible requirements. This will help reduce your out of pocket claim exposure.

Keep in mind – HSA compatible health plans are required to have high deductible requirements in all benefit categories. If you want to contribute pretax monies into a Health Savings Account, you cannot avoid these mandatory deductible requirements.

Deductibles are usually based on a plan year, not per incident. For example, most health insurance plans with deductibles will make you satisfy the deductible once during the year. Once you satisfy your deductible, it is usually satisfied for the rest of the year. Satisfying the deductible can occur in a single claim or over the course of the year with multiple claims. Be careful – not every claim accumulates towards your deductible. For example, copays do not accumulate towards your deductible, but they accumulate towards your maximum out of pocket.

Copays

Deductibles are confusing and can cost you a lot of money out of pocket. Fortunately, copays are easy and straight forward! Copays are a flat rate fee for a service. For example, if your plan has a $20 Primary Care Physician copay, you will pay $20 for the office visit and the insurance company will pay the rest. It is important to review your summary of benefits to make sure there are no deductible requirements before your copay benefit.

Copays are transparent. Since it is a flat rate fee and usually does not have deductible requirements, you will know the cost of your medical appointment before you walk in the doctor’s office. If you are receiving medical care under a copay benefit, the doctor’s office usually collects the copay at the time of your appointment. On the other hand, your doctor sends claims to your insurance company first for medical services subject to the deductible. You will then receive a bill in the mail a few weeks or months later.

If you’re self-employed and looking for health insurance, you’re probably familiar with some key terms. You’re probably also tired of hearing a dictionary’s-worth of health jargon, much of which isn’t always clear. We’ve got you!

“Deductible” and “copay” are two of the most common health insurance terms, though many people aren’t totally clear on what they mean. We’ll walk you through the meaning of each and what to consider when you see these terms on different health insurance plans.

Health insurance deductibles, explained

The quickest definition for a deductible is that it lets you know what you're paying out of pocket before your insurance kicks in to cover services. An important thing to note is that deductibles and monthly premiums tend to be inversely related. The lower the deductible on your health plan, the higher the monthly premium usually is.

Health insurance deductibles are different than other insurance deductibles (e.g. car insurance) in that the latter is usually applied per each claim, whereas health insurance deductibles cover the entire year.

Not every health service is related to your deductible, either. Many preventive services and, in some cases, primary care, are offered at no cost to the policyholder. This varies by coverage type, so be sure to check your certificate of coverage.

Deductibles can also be broken down by individual or family. Family deductibles may be one lump sum that applies to the entire family or each family member covered under the plan may have an individual deductible that goes toward the family deductible (i.e. a family of four may have a family deductible of $2,000 that breaks down to an individual deductible of $500 per member).

Typically, after a deductible is met, you share the cost of healthcare services with the insurance company. This is called coinsurance. Coinsurance is usually defined as a percentage of costs that you are responsible for, which usually breaks down as follows:

As an example, let’s say you have a silver plan that has a $2,000 deductible, and you have met the deductible. You took an awesome trip to the Sundance Film Festival and decided to take a day for skiing, but the slopes were brutal and you broke your leg. If the total cost for treating your leg was $2,500, you’d only be responsible for $750:

$2,500 X 30% = $750 (you pay)$2,500 X 70% = $1,750 (insurance pays)

High-deductible plans

A high-deductible health plan (HDHP) is exactly as it sounds: a plan that has a high deductible. These plans usually offer the lowest monthly premiums. HealthCare.gov describes such plans as having an individual deductible of at least $1,350 or a family deductible of at least $2,700.

These plans can be appealing for those who want to minimize monthly premium costs or who don’t anticipate having many health care needs throughout the year. Also known as “catastrophic health plans”, these are meant to protect people if the worst happens. If you have a medical emergency resulting in tens of thousands of dollars in medical expenses, you can get coverage for any covered health services that go over the deductible. On the other hand, you also typically pay for all health care costs out of pocket until the deductible is met, which can still amount to several thousands of dollars. Some people choose to combine an HDHP with a health savings account (HSA), the latter of which lets you pay for qualifying medical expenses with contributed funds that are not subject to federal income tax. It’s one way to minimize routine health care costs while still maintaining coverage for worst-case scenarios.

No Deductible No Copay Health Insurance Policy

Health insurance copays, explained

A copay, short for “copayment”, is a fixed amount you pay to a provider for a covered service. Copays tend to vary, depending on the service required. For example, an office visit to a doctor may have a $20 copay, which must be paid before the service is rendered. A copay for a specialist visit may be a little higher, between $30-$50. The general rule of thumb is that routine visits and exams, the copays tend to be lower (e.g. annual checkups, mammograms, gynecological exams). Exams or treatments that are more specialized (for a specific condition, perhaps) tend to have higher copays.

No Deductible No Copay Health Insurance

In some cases, copays are only paid after the deductible is met. It’s also worth noting that many plans cover basic services (annual checkups, preventative screenings, etc.) even before the deductible is met.

Deductible vs Copay: what’s the difference?

Copays and deductibles are both features of health insurance plans and dictate how much the insured pays for health services, though amounts and frequencies vary. A copay is a fixed amount paid by a patient for receiving a particular health care service, with the remaining balance covered by the person's insurance company. A deductible is a fixed amount a patient must pay during a given time period (usually the plan year) before their health insurance benefits begin to cover the costs.

Generally, plans that charge lower monthly premiums require higher copayments and higher deductibles, while plans that charge higher monthly premiums have lower copayments and lower deductibles.

In general, the deductible represents the total amount you will have to spend on covered health care services before your health coverage starts to kick in. The copay is a smaller amount you are responsible for.

Copays may not be applied toward the deductible under certain health care plans. That means that if you have a chronic illness or injury that requires multiple specialist or doctor visits, you may be racking up out-of-pocket costs that don’t apply to your deductible, leaving you on the hook for a long health care bill.

How does Decent do deductibles and copays?

When it comes to Decent healthcare plans, the name of the game is affordable, comprehensive healthcare coverage. Our Trailblazer silver plan (the most popular plan) has super low copays for many services compared to other traditional silver plans. Our deductibles are lower, too! Our trailblazer plan has a $4,500 deductible, which can be as much as 40% lower than traditional silver plan deductibles.

No Deductible No Copay Health Insurance Coverage

The coolest part is that we offer 100% free primary care. No copays for visits with your primary care physician. You don’t have to wait until you reach your deductible. Just go to your primary care physician whenever you want and pay $0. We believe the doctor-patient relationship sits at the center of healthcare, so we’ve designed our plans around it.

No Deductible No Copay Health Insurance Program

For more information about our healthcare plans, visit Decent.com and get your free quote today!